Hybrid work is accelerating the cloud’s trend from on-prime security

The Secure Services Edge (SSE) market is heating up, according to a new report by market research firm Del’Oro Group. The company said the SSE market grew 40% year-on-year to $ 800 million in the first calendar quarter of 2022.

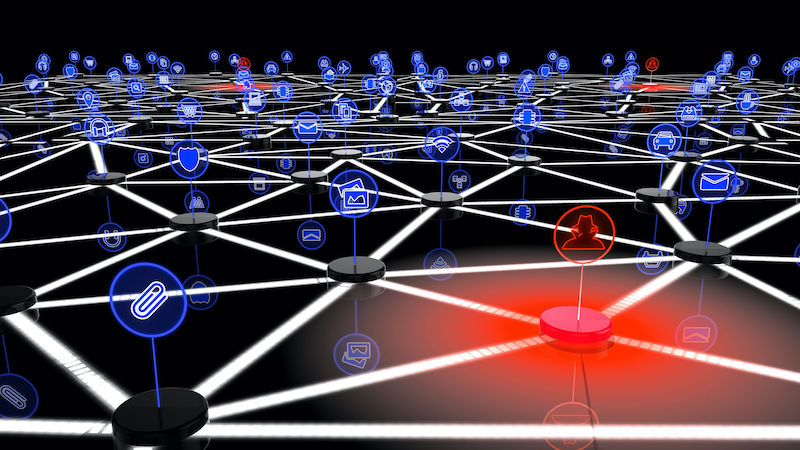

SSE is a Gartner-printed abbreviation, So straight from the horse’s mouth: “Security Edge (SSE) protects access to the web, cloud services and personal applications. Capabilities include access control, threat protection, data protection, security monitoring, and acceptable usage controls implemented by network-based and API-based integration. SSE is primarily provided as a cloud-based service and may include on-premises or agent-based content. ”

SSE services including a Secure Web Gateway (SWG), Firewall-A-Service (FWaaS), Zero-Trust Network Access (ZTNA) and Cloud Access Security Broker (CASB). SSE basically describes Secure Access Service Edge (SASE), software-defined wide area networking (SD-WAN) is missing.

An SWG intervenes between the user and the Internet, ensuring that malicious software is blocked. ZTNA ensures that users only have access to the network resources needed to accomplish their task. CASB provides a security policy enforcement framework. FWaaS Services consists of Next Generation Firewall (NGFW) functionality as software: NGFW systems include traditional capabilities such as dynamic packet filtering, or stateful inspection, network address translation (NAT) and virtual private network (VPN) support.

While SSE products are able to be deployed on-premises or delivered on-demand as a cloud-based service, enterprises increasingly prefer cloud-based security, according to Mauricio Sanchez, research director, network security, and the Oro Group, according to SASE & SD-WAN. Sanchez explained that the rapid growth of distributed enterprise apps and the growing demand for hybrid work accommodation are driving this growth.

Other highlights of the report: Year after year, FWaaS and ZTNA revenue more than doubled, while SWG and CASB revenue increased by about 30%. According to Del’Oro, SASE networking and security revenue grew by about 30% year-over-year.

Developers providing full-stack SSE and SASE solutions demand easy management, scalability, and operational efficiency for enterprises. Dell’Oro says the integrated SASE platform market has achieved three-digit growth over the years.

Dell’Oro’s searches are in line with Gartner’s expectations. Gartner claims that SASE is the fastest growing cloud opportunity in the network security market, and predicts that the SASE market will grow by more than 41% in 2022.

While enterprises are investing more in cloud-based security solutions to help with hybrid work than ever before, a survey published earlier this year says most companies have no idea how to handle this new reality, although they acknowledge it. A survey by AT&T, Dubber and Incisiv shows that hybrid work, or a combination of personal and remote work, is expected to become the “standard operating model across the industry” in two years, rather than as an employee benefit.

But there is a big challenge. Seventy-two percent of surveyed businesses still do not have a detailed hybrid job strategy, and there is tension between what companies want versus what their employees want: 86% believe their employees want hybrid jobs, but 64% say their executives prefer jobs to happen on-premises.

Fortunately for all of us, nature hates a void with the same violence that Gartner prefers an acronym. And thus, SSE and SASE solutions help fill the gaps across the enterprise landscape.

![15 Common SEO Mistakes You Must Avoid in 2021 & Beyond [Infographic]](https://www.socialmediatoday.com/user_media/cache/ee/55/ee55ab49895c8079d3a0d6afe8998eaf.jpg)