The merger of Sprint and T-Mobile, which was first announced in April 2018, finally closed in April of 2020 after two years of wrestling with opponents and negotiating with the U.S. government.

T-Mobile CEO and President Mike Sievert has joked that the government “accidentally” gave them extra time to prepare for the event. They used the time to make a plan that was “rock solid,” and they executed during a time when “everything was falling apart” during the global pandemic, Sievert said at a recent investor event.

Eight months after the deal closed, he still had not had his entire senior management team physically present in a room together.

Yet they managed to get a lot done when Zoom meetings and social distancing became the norm. They flipped the switch on marketing and distribution in early August, sunsetting the Sprint brand and using T-Mobile for postpaid and Metro by T-Mobile for prepaid. (It’s worth noting that, based on recent checks by Wave7 Research, the Sprint brand remains at Sprint affiliates Shentel in the Northeast and Swiftel in South Dakota.)

On the network side at last check, 15% of Sprint postpaid traffic had moved over to the T-Mobile network. Of course, T-Mobile was pretty lukewarm about 2.5 GHz before the merger, but once it was announced, its intentions were clear. Since the merger closed, it’s been working at a frenzied pace to deploy the 2.5 GHz spectrum for 5G. In many eyes, that 2.5 GHz spectrum is the crown jewel and the reason T-Mobile went to bat so hard to get the deal done.

By the end of this year, T-Mobile’s network team, led by President of Technology Neville Ray, was upgrading over 1,000 towers a month to 2.5 GHz. That’s in addition to the low-band 600 MHz layer that T-Mobile launched in December 2019, providing the base of the 5G spectrum “layer cake” that Ray likes to talk about.

The 2.5 GHz serves as the middle layer, with millimeter wave (mmWave) topping the cake in areas where high-band spectrum will be strategically deployed. T-Mobile now refers to its 600 MHz 5G deployment as “Extended Range” 5G, while the 2.5 GHz and above is referred to as “Ultra Capacity 5G.”

RELATED: T-Mobile’s Ray: It’s game on – and btw, voice on 5G is coming

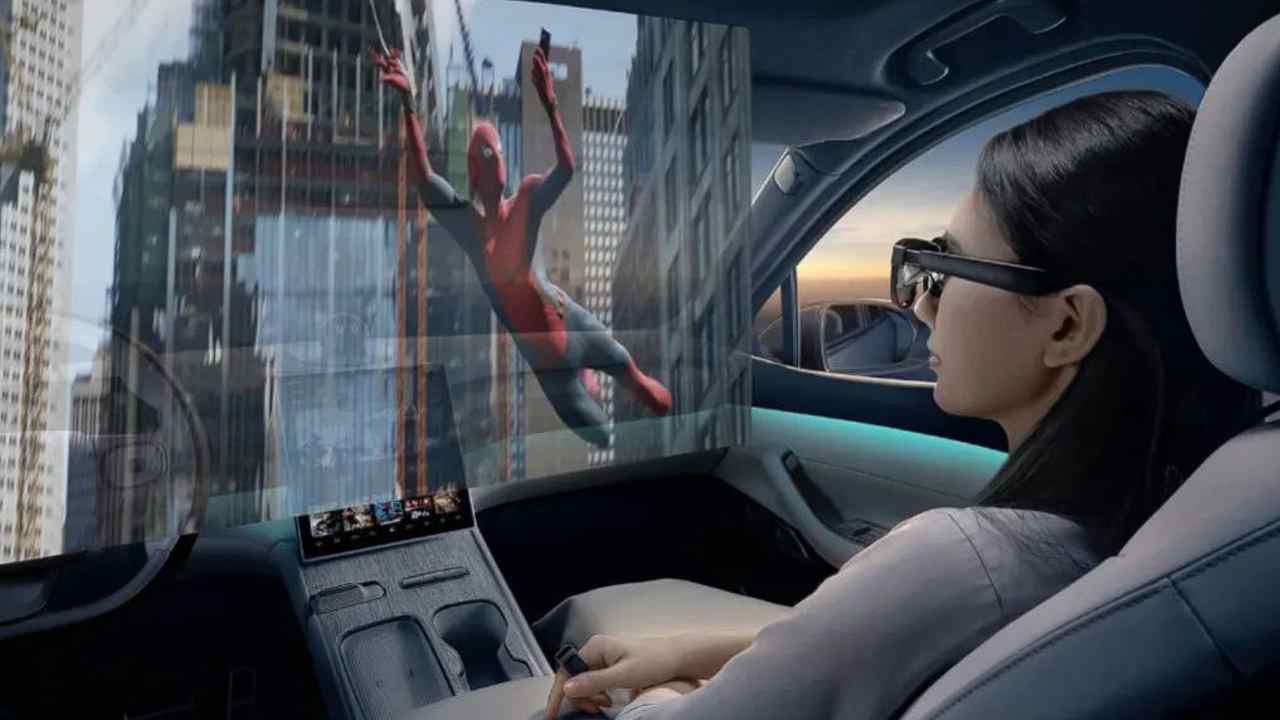

Interestingly, the “Ultra Capacity” moniker was introduced in a press release about its first 5G capable hot spot, the Inseego 5G MiFi M2000. T-Mobile said customers could expect speeds that rival Wi-Fi by using its Ultra Capacity service while they’re on the move.

The 2.5 GHz spectrum gives T-Mobile the bragging rights to download speeds of around 300 Mbps and peak speeds up to 1 Gbps. “That’s a pretty remarkable speed that sets T-Mobile apart from the competition,” said Jeff Moore, principal of Wave7 Research, in a recent interview.

Granted, Verizon boasts super-fast speeds using its mmWave spectrum, but that’s only available in parts of 61 cities, and questions linger whether Verizon’s Nationwide 5G, offered via the deployment of Dynamic Spectrum Sharing (DSS), is really faster than LTE speeds, he added.

T-Mobile has said its Extended Range 600 MHz 5G is capable of producing speeds two times faster, and in some cases, three times faster than LTE. But the 2.5 GHz offers significant mid-band benefits, and T-Mobile has said it plans to turn on 2.5 GHz 5G sites to cover a population of 100 million by the end of 2020 and 200 million people by the end of 2021, when it can then boast a nationwide 5G presence with 2.5 GHz.

Moore noted that the “uncarrier” on December 14 launched a new TV ad introducing the Ultra Capacity 5G concept and has been running it ever since, including during NFL games over the past weekend.

Dish makes progress with 5G

The other big component of the government’s approval of the T-Mobile/Sprint merger is for Dish Network to emerge as the fourth facilities-based carrier, so the industry essentially goes from four to three and back to four nationwide players.

Dish co-founder and Chairman Charlie Ergen has recognized that skeptics are out there – after all, Dish for years sat on spectrum without any network to show for it, with many suspecting it was holding out for the highest bidder (who never showed.) But this past summer, he said: “We’re just going to do it,” rather than try to convince skeptics about their plan.

Dish hired industry veterans to run its Boost Mobile business and finalized plans for its one-of-a-kind open radio access (RAN) network, which will be 5G standalone (SA) from the get-go. It’s using virtualization and cloud technologies, with the expectation that it will be able to serve retail and wholesale customers with a unique offering.

Dish named Mavenir as its first network vendor and steadily added to the list. It’s working with Altiostar, Fujitsu, Nokia, Qualcomm, Intel, VMware and others, including fiber providers and tower companies like Crown Castle. In December, Dish said it had conducted a test of its fully virtualized 5G core network in Cheyenne, Wyoming, where it integrated and validated end-to-end 5G connections using the industry’s first O-RAN compliant FDD radio, developed by MTI.

Dish executives have said they believe they can build a 5G network for $10 billion, a figure that some analysts say is far too low. Dish can build a basic network for $10 billion, but that means it will need to invest another $10 billion the next year to improve and expand, said industry analyst Roger Entner of Recon Analytics.

“Do I believe that Charlie can build a network for $10 billion? Yes,” Entner told Fierce. “But that’s not the end of it. That’s the beginning of the story.”

Incumbent operators continue to spend more on their networks every year. “The last carrier that stopped spending on its network was Sprint, and look at what happened there.”

/https://specials-images.forbesimg.com/imageserve/5fea7909a1d890d7f5a3cbba/0x0.jpg)